Dental Loss Ratio - DLR

What is DLR and Why Should I Care?

DLR is the dental sibling to Medical Loss Ratio (MLR)

DLR is the percentage of insurance premiums that is spent on patient care, rather than on overhead costs like executive salaries and administration.

LB 639 requires dental insurance companies to spend 85% of your premiums on your oral health care. Currently, if those premium dollars are not spent on your oral health care, the insurance company keeps those dollars!

What LB 639 does for patients:

- Adds transparency to dental insurance - what percent of your premium is spent on your care.

- Establishes a minimum percentage of premiums (85%) that dental insurers must spend on patient care.

- Requires carriers who do not meet the threshold to refund the difference to covered patients and groups.

What Dentists Need to Do - Print off the Dentist Outreach Guide for LB 639

Download the Dental Office Flyer and post next to your patient checkin area.

What Patients Need to Do

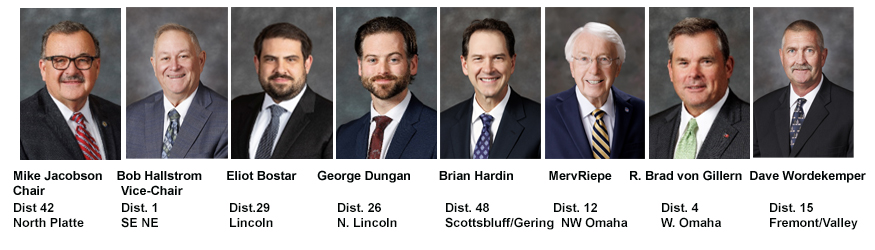

LB 639 will be scheduled for hearing in front of the Banking and Insurance Committee (shown below) March 10th

Email the Senators, asking them to support LB 639 and advance this bill to General File.

Email Contacts:

Sen. Mike Jacobson, Chairperson * Sen. Bob Hallstrom, Vice Chairperson * Sen. Eliot Bostar * Sen. George Dungan

Sen. Brian Hardin * Sen. Merv Riepe * Sen. R. Brad von Gillern * Sen. Dave Wordekemper

Consumer Choice Center Supports Dental Loss Ratio

WASHINGTON, D.C. – The global consumer advocacy group Consumer Choice Center launched a policy primer on the feasibility of enforcing medical-loss ratios and rebates for dental insurance in order to benefit patients.

The primer examines how medical-loss ratio is used in other medical categories, international comparisons, and how it would lead to a more open and competitive dental insurance market that would unlock savings for patients.