Can My Dentist Charge Me

More Than My Dental Plan Allows?

Background

Many dentists sign contracts to provide dental services to patients that have a particular dental benefit plan. Part of that contract requires the dentist to accept a set fee for a defined procedure.

In 2008, insurance companies began changing their contracts to force participating dentists to accept a lower fee for a dental procedure that the insurance company didn't want to pay a benefit to you, the patient, creating specific contractual situations.

In 2008, insurance companies began changing their contracts to force participating dentists to accept a lower fee for a dental procedure that the insurance company didn't want to pay a benefit to you, the patient, creating specific contractual situations.

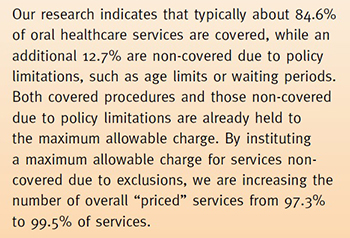

The image to the right is from page 7 of a 2008 Delta Dental newsletter (non-covered), explaining the change. Delta admits that 12.7% of oral health care services are not-covered due to policy limitations, such as age limtis or waiting periods. See also the Delta Dental of Iowa Policy Limitation Specifiying Not Covered Services

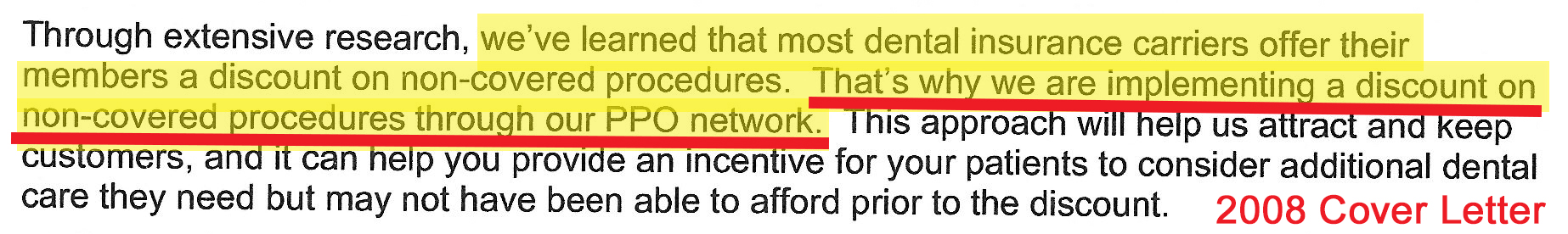

In 2008, Ameritas sent the cover letter below along with a 2008 Ameritas Contract Amendment JPEG, asking particpating dentists to sign and accept lower fees for non-covered services.

Is it fair for the insurance company to pay nothing, while forcing the dental office to accept a reduced fee that they did not agree to? Of couse not!

Before the NDA passed its LB 810, provider contracts were negotiated as you can see by the signature lines in the 2008 Ameritas Amendment. Beginning in 2012, these are no longer negotiated contracts. Here is an example of 2012 Ameritas Amendment to a dental office "telling" them that they will now accept a lower fee for a non-covered service, even though the NDA just passed its non-covered services statute. There are no signature lines to indicate the dentist accepted this change.

To offset this inequity for the dental office, the NDA passed LB 810 in 2012, now 44-7,105 in the Nebraska Statutes.

Section 44-7,105 prohibits a dental benefit plan from "limiting any fees charged for dental services that are not covered by the policy, certificate, contract, agreement, or plan."

Because the Nebraska Department of Insurance has interprested this statute both ways, the NDA filed a lawsuit for the court to clarify the intent of this language, specifically looking at the Legislative History. The Court heard the Summary Judgement motion on September 27, 2021. In December 2021, the Court refused to settle the issue as requested. We did received some instructive documents through the Discovery process that you will read below.

As Delta Dental mentioned above, policy limitations, such as age limtis or waiting periods. The other policy limitations include: Frequency Limitations, Annual procedure limit, such as only 2 Topical Fluoride Applications, Alternate Benefit Services, Annual Benefit Cap and Bundling Codes.

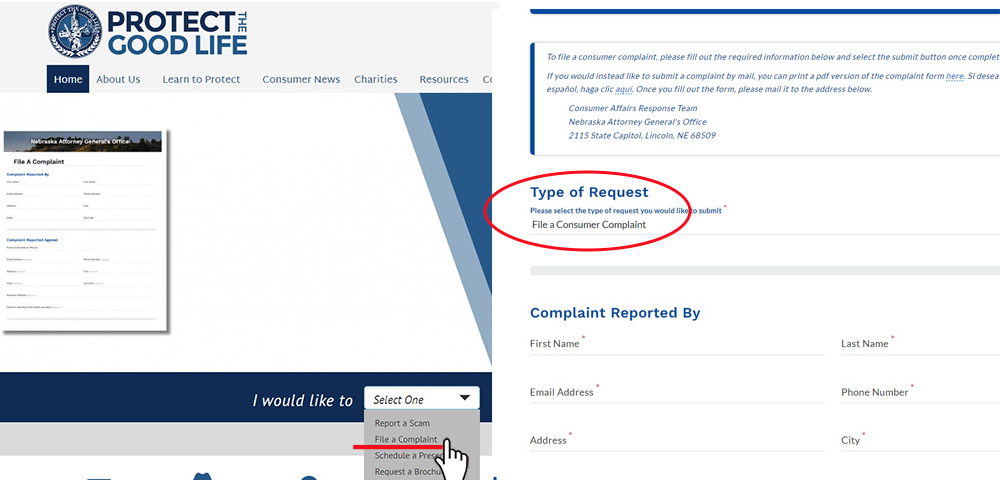

File a Complaint with the Attorney General's Office

If you’ve had an insurance company force you to accept a lower fee for a non-covered service, the Attorney General’s Office said that dental offices and patients can submit complaint to their office. Click Protect the Good Life and in the "I would like to" drop down menu, click "File a Complaint."

On the next page, scroll down and make sure the File a Complaint box is chosen. Fill in the information about your non-covered services complaint, explaining what has happended up to this point. There is a place where you can upload a file. If possible, upload the EOB you received from the insurance company.

Once you click Submit, your complaint will be directed to the Consumer Protection Division.

Examples - Alternate Benefit

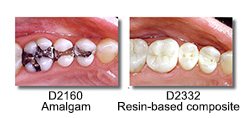

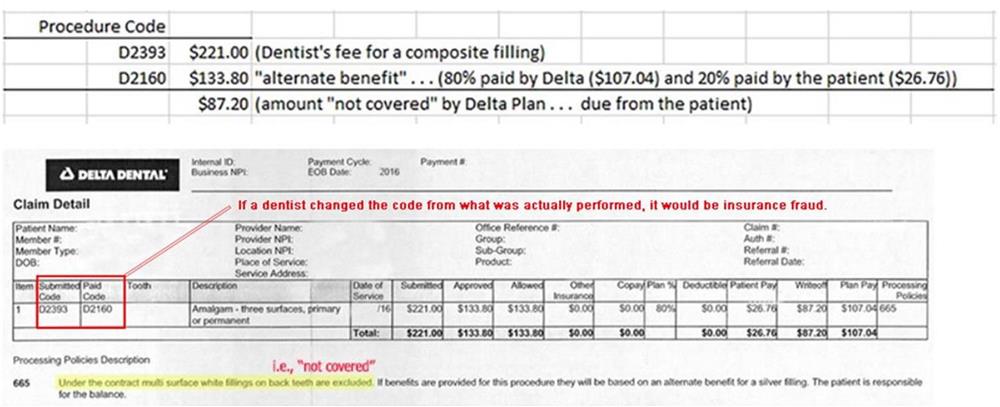

However, all procedures are not the same. Each procedure has a distinct CDT Code (Code of Dental Technology) A "filling" for example, can be a D2160 amalgam filling or a D2332 composite - tooth-colored filing. The tooth-colored filling more expensive. See the example Explanation of Benefits image below.

However, all procedures are not the same. Each procedure has a distinct CDT Code (Code of Dental Technology) A "filling" for example, can be a D2160 amalgam filling or a D2332 composite - tooth-colored filing. The tooth-colored filling more expensive. See the example Explanation of Benefits image below.

However, most dental benefit plans do not "cover" a tooth-colored filling and many patients do not want a silver, or amalgam filling. Dental benefit companies were forcing dentists to accept a lower price (amalgam) for the patient receiving a higher priced procedure (tooth-colored filling).

However, during this litigation the NDA received a letter written by NDOI attorney Laura Arp to Ameritas in 2015. - specifically addressing the NDA's noncovered services statute.

In the letter to Ameritas, Ms Arp states, If Dental Benefit Plan never pays for the more expensive "alternate benefit", then the more expensive "alternate benefit" is not “covered by the policy” and Dental Benefit Plan cannot dictate the price for that service.

Ms. Arp's Affidavit dated August 10, 2021 is consistent with her 2015 letter.

This sentence applies to all of our non-covered situations. If Dental Benefit Plan never pays for ______________, then ________________ is not “covered by the policy” and Dental Benefit Plan cannot dictate the price for that service.

For example: If Dental Benefit Plan never pays for services exceeding an annual cap, then services exceeding an annual cap are not “covered by the policy” and Dental Benefit Plan cannot dictate the price for that service.

Just fill in the blank with a common non-covered situation:

- A third cleaning in a calendar year;

- fluoride treatments for children over 18;

- dental services within 6 months of starting a job (waiting period);

- dental services exceeding the annual cap;

- downcoding from the actual code provided, to a less expensive code (alternate benefit)

- the actual dental code performed (and paid) bundled with another dental code (unpaid).

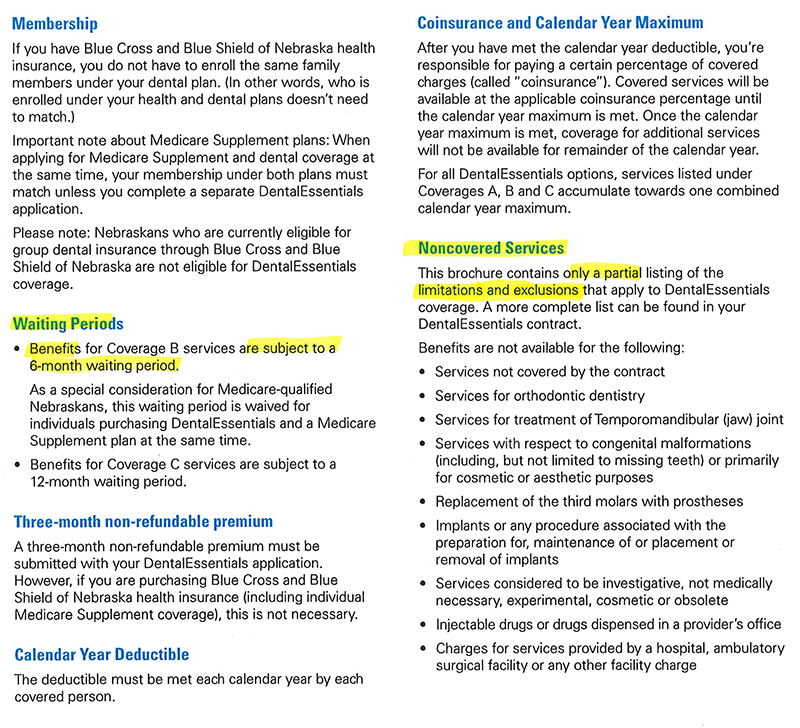

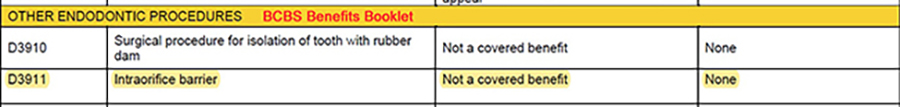

Dental Benefit Plan booklets describe what the plan covers. The example below is a Blue Cross Blue Shield booklet explaining dental benefits. They have specific sections titled "Waiting Periods" and "Non Covered Services."

Alternate Benefit Example of Non Covered Service

In the above example, the dental benefit plan that "does not cover" tooth-colored fillings. However, the plan will provide an "alternate benefit," which is the reimbursement cost for an amalgam filling. Because the dental benefit plan did not cover (or pay for) a tooth-colored filling, then the patient must pay the difference between the amalgam "alternate benefit" and the tooth-colored filling fee.

The image below is an example of an EOB (Explanation of Benefits) from Delta for a patient that received a tooth colored filling (D2393) and the Delta plan only covered an amalgam filling (D2160). Delta is paying an "alternate benefit" of $133.80 which is the amount the contract provides for an amalgam filling (D2160). In this example, the patient is paying 20%, or $26.76, for their portion of the $133.80. However, the patient is also responsible for the difference in the amount of the composite filling ($221.00) and the $133.80 amount that Delta calculated for an amalgam filling, for a balance of $87.20.

Example EOB "excluding" (not covered) white fillings

Very often a procedure is not "covered" by a dental plan, but the plan will pay for a lower priced "alternate benefit." See the letter written by NDOI attorney Laura Arp to Ameritas in 2015. - specifically addressing the NDA's noncovered services statute. "The choice of two "alternate benefits" does not make both benefits "covered" when the insurer only pays for the lowest cost alternative.

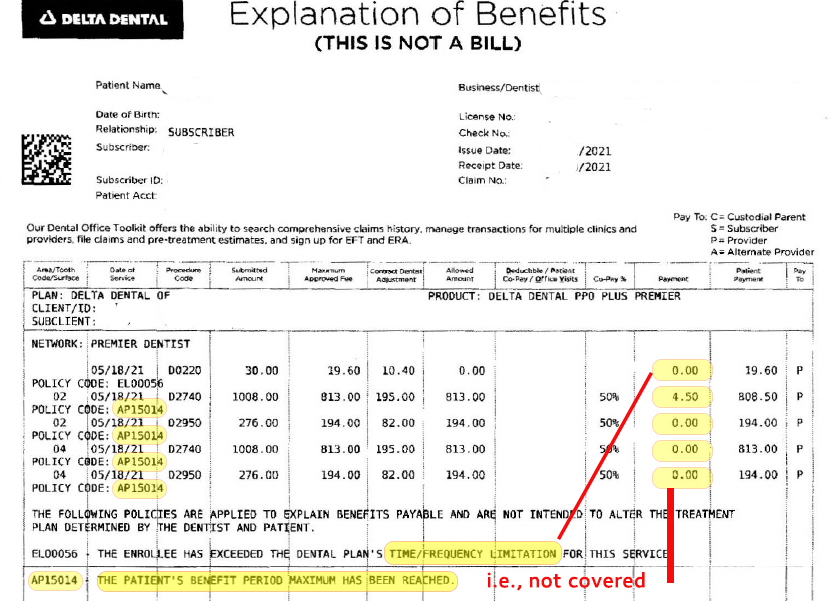

Exceeding the Annual Cap / Frequency Limitation Example

The example below shows both exceeding the Annual Plan Benefit allowance (usually between $1,000 and $1,500) and the frequency limitation. When the NDA testiified on our non-covered services legislation, we specifically listed the $1,000 annual limitation. See page 5 of the Legislative History.

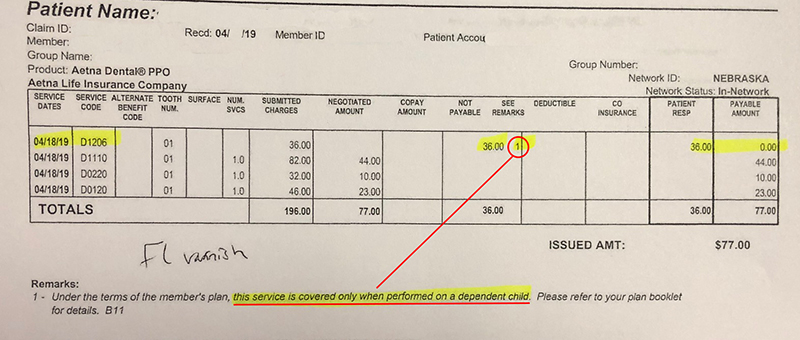

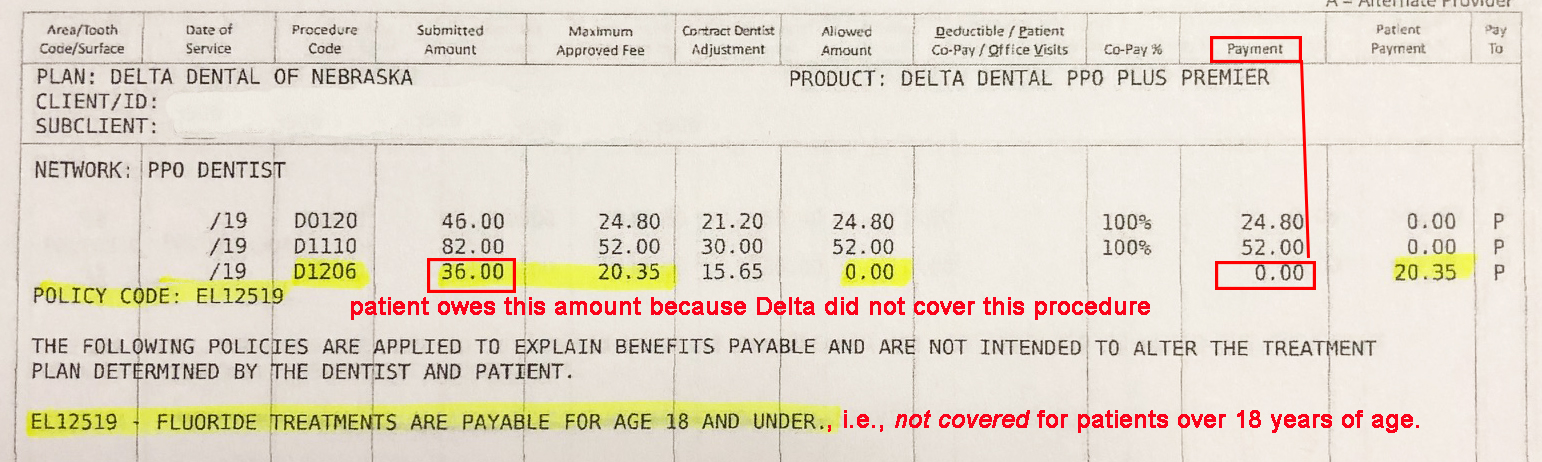

Age/Dependant Examples of Non Covered Service

Dental Plans will also not cover some services because of age restrictions or dependant status of the patient. In the example below, Aetna does not cover a Fluoride Varnish for a patient who is not a dependant child . . . 'this service is covered only when performed on a dependant child." This is another way to say the service is not covered. However, Aetna shows their fee schedule of $36.00 as the patient's responsibility, when the Nebraska statute above does not allow Aetna to limit the fee.

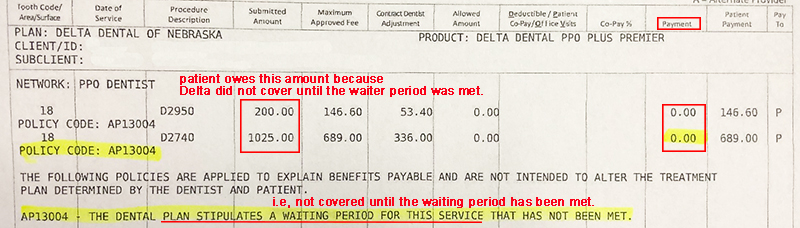

Wating Period Example of Non Covered Service

Some plans require a waiting period before a patient's benefits begin to take effect. The example below shows D2740 porcelain/ceramic crown . . . which most plans don't covered because they are more expensive than a D2790 (full cast high noble metal crown). In this example, Delta is not covering the crown because the patient has not waited long enough for the benefits to begin.

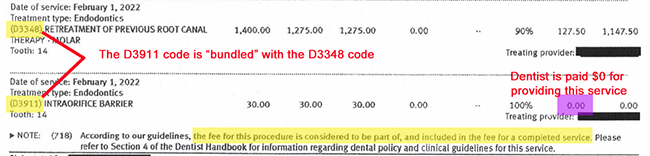

Bundling Example of Non Covered Service

Bundling of Procedures – The systematic combining of procedures (codes) resulting in a reduced benefit to the patient. Examples of EOB footnotes on Bundling are: This fee is part of the total fee for this procedure; and The dental plan contract considers this portion to be part of ____, therefore, separate benefits are not available.

The image below is an example of a bundled procedure codes. The D3911 procedure actually provided to the patient is bundled with the D3348 code - as "part of" that code. Other plans, as shown in the BCBS Benefits Booklet, simply declare a D3911 procedure "not covered."

Are Federal Plans Required to Follow Nebraska Law?

Yes they are.

Many administrators mistakenly think that just because the Plan is "federal," Nebraska law is "pre-empted" by ERISA from applying to their plan.

In Rutledge v. PCMA, 141 S. Ct. 474, 208 L. Ed. 2d 327 (2020), the United States Supreme Court clarified when a state law is pre-emempted by ERISA.

As the Court states, ERISA is therefore primarily concerned with preempting laws that require providers to structure benefit plans in particular ways, such as by requiring payment of specific benefits, or by binding plan administrators to specific rules for determining beneficiary status (p.4-5).

In analyzing the Arkansas law in Rutledge, the Court stated, "In short, ERISA does not pre-empt state rate regulations that merely increase costs or alter incentives for ERISA plans without forcing plans to adopt any particular scheme of substantive coverage.

Nebraska's Non-Covered Services law simply states:

Section 44-7,105 prohibits a dental benefit plan from "limiting any fees charged for dental services that are not covered by the policy, certificate, contract, agreement, or plan."

If a dental plan does not cover a service, as show in the examples above, the dental plan cannot limit the fee charged by the dental office.